paydayloanalabama.com+elba no credit check loan payday

5 Techniques for Refinancing Your own Jumbo Financing

The financing criteria for a jumbo mortgage are a lot more difficult in order to satisfy than just a basic, compliant loan. These exact same criteria use if you are searching in order to refinance your jumbo loan. However if interest levels is lower enough, refinancing is going to save borrowers exactly who took on oversized loans some an excellent bit of money. Prior to beginning trying to get an excellent refi, though, be sure to stick to the following suggestions. These are typically examining your credit score, getting your economic data files ready to go and you may figuring out how much refinancing could save you.

Refinancing was a primary financial circulate, therefore speak with an economic mentor observe the way it you will affect their much time-name financial arrangements.

Tip #1: Determine How much Refinancing Can save you

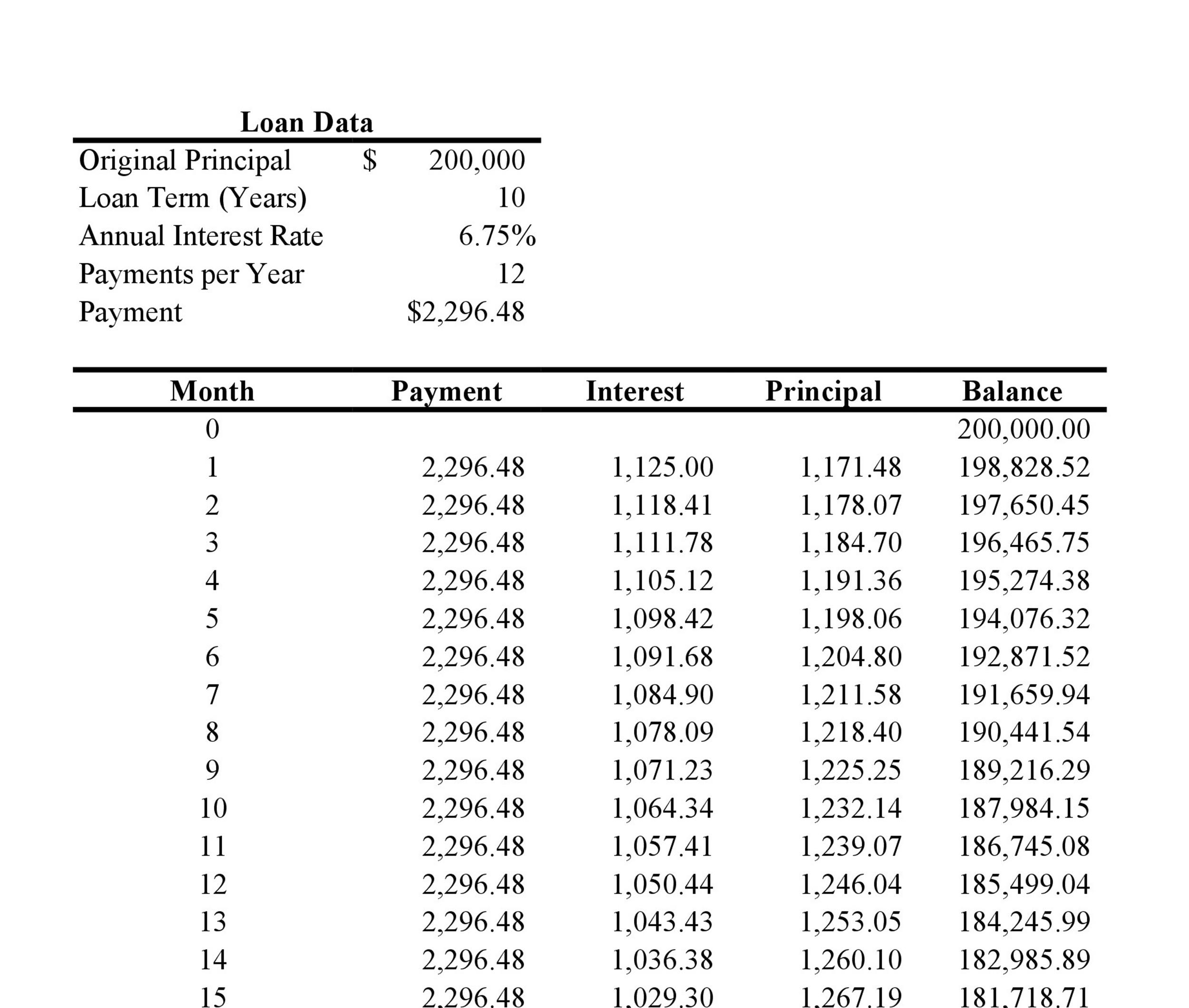

Do not forget to check out the break-even months, or the area of which you get straight back the expenses from refinancing during your focus offers. When you have a great jumbo loan, actually a portion of a big change on your interest can be possess a serious effect on the much time-label coupons.

Suggestion #2: Pick If You are able to Cash-out People Worthy of

That have home values on the rise, of many jumbo financing holders are utilizing a great refinance as the possibility to help you utilize a few of the equity they usually have based. If you prefer more income to invest in a property restoration otherwise combine financial obligation, you can look at discover more money compliment of a cash-away re-finance.

Regardless of if you’re not going to carry out a money-aside refinance, it is best to know simply how much equity you have got. When you yourself have a great number of home guarantee, it’ll be easier so you’re able to persuade the lender to lead you to refinance their jumbo loan. Typically, it is best to have at the least 20% collateral of your house beforehand dealing with loan providers on good the new loan.

Tip #3: Check your Credit rating Recent Records

Refinancing one real estate loan comes to a credit history and records check. And in case considering refinancing jumbo financing, loan providers need exactly how strong someone’s credit score was.

The reason being there can be constantly more funds at stake. Including, jumbo financing are not supported by Federal national mortgage association and you may Freddie Mac computer, as they are larger than brand new compliant loan restrictions put of the the latest Government Homes Money Agencies (FHFA). In place of which support, lenders could well be into hook for mortgages that standard.

Not merely do your credit score connect with if you could potentially refinance your jumbo loan but inaddition it provides an effect on the sort of rates your be eligible for. You need to work at driving your own FICO score past the 700-mark if you want the means to access by far the most favorable words.

Idea #4: Get the Paperwork in order

Underwriting laws getting jumbo fund are very significantly more stringent as the houses collapse. This means you’ll need to have got all the papers manageable if you like a try in the refinancing the mortgage. This is exactly why it is advisable to take some for you personally to assemble your earnings stubs over the past 2 to 3 days, their taxation statements regarding the early in the day couple of years plus lender comments regarding earlier in the day half a year.

When you’re mind-functioning, be ready to bring a copy away from a profit and you may losses statement, together with sources to confirm your work standing while you are operating while the another company.

Suggestion #5: Thoroughly Search Current Re-finance Prices

Before you could refinance one mortgage, you should compare rates from various other loan providers. That way you’ll have an idea of just what you can easily be eligible Elba cash advance for. Looking around may possibly give you a way to discuss words if you learn a lender we wish to work with.

Besides haggling the right path to help you a far greater rates, it is better to try and score a deal on the your settlement costs because they could add thousands of dollars so you can the expense of your refinance.

Conclusion

Refinancing would-be a lifesaver getting homeowners exactly who had a good jumbo loan simultaneously whenever home loan prices was negative. But simply such obtaining a good jumbo loan, the process to have refinancing is tough and full of strict standards. For this reason its vital that you have your money and you may documentation when you look at the buy even before you start implementing.